ABOUT THIS REPORT

To assess how ongoing US-China trade frictions may affect the US semiconductor industry, the Semiconductor Industry Association (SIA)commissioned Boston Consulting Group to conduct anindependent study. The work included detailed modeling of the global demand andsupply dynamics across end application markets and semiconductor product categories. BCG is wholly responsible for the analysis and conclusions that appear in this report.

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group (BCG) is a leading global management consulting firm, with offices in over 50 countries. BCG partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we help clients with total transformation—inspiring complex change, enabling organizations to grow, building competitive advantage, and driving bottom-line impact.

ABOUT THE AUTHORS

Antonio Varas is a managing director and senior partner in the Silicon Valley office of Boston Consulting Group and is a core member of its Technology, Media & Telecommunications practice. You may contact him by email at varas.antonio@bcg.com.

Raj Varadarajan is a managing director and senior partner in the firm’s Dallas office and leads its Global Advantage practice in North America. You may contact him by email at varadarajan.raj@bcg.com.

ACKNOWLEDGMENTS

This report would not have been possible without the contributions of our BCG colleagues Abhinav Duggal, Ray Loa, Christine Jarjour, and Emily Horton. The authors also thank Pete Engardio for writing assistance and Steven Gray, Katherine Andrews, Kim Friedman, Abby Garland, Frank Müller-Pierstorff, Shannon Nardi, Paola Oliviero, and Alex Perez for editing, design, production, and marketing

EXECUTIVE SUMMARY

strong semiconductor industry is critical to US global economic competitiveness and national security in A an era of digital transformation and artificial intelligence. The US has long been the global semiconductor leader, with a 45% to 50% share. US leadership is grounded in a virtuous innovation cycle that relies on access to global markets to achieve the scale needed to fund very large R&D investments that consistently maintain US technology ahead of global competitors.

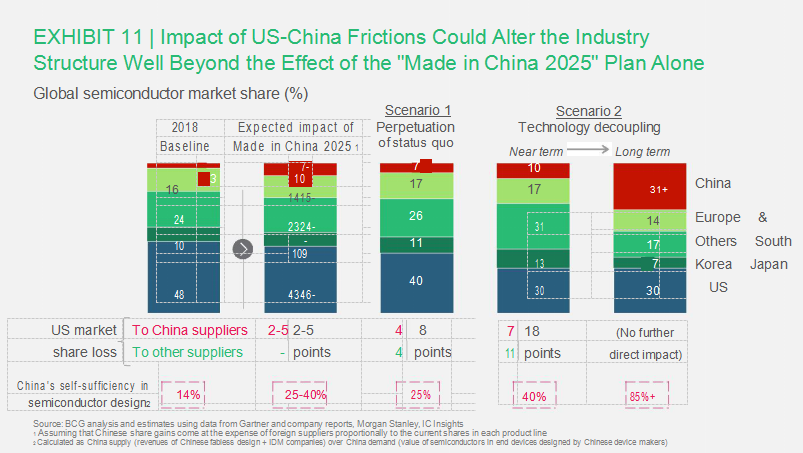

Excluding the manufacturing activity of Chinese factories for foreign companies, Chinese companies account for 23% of global semiconductor demand. Today, China’s semiconductor industry (without the manufacturing plants built by foreign semiconductor companies in China) covers only 14% of its domestic demand. We estimate that the “Made in China 2025” plan will increase China’s semiconductor self-sufficiency to about 25% to 40% by 2025, reducing the US global share by 2 to 5 percentage points.

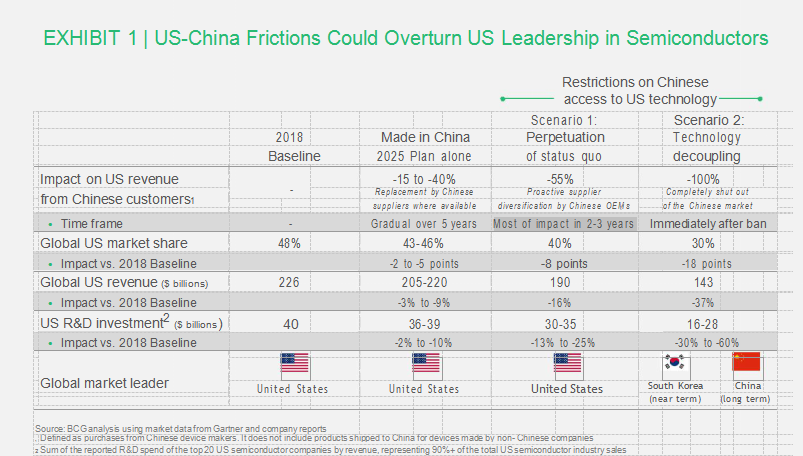

Broad unilateral restrictions on Chinese access to US technology could significantly deepen and accelerate the share erosion for US companies. (See Exhibit 1.) Established alternative non-US suppliers exist already for over 70% of Chinese semiconductor demand. Over the next three to five years, US companies could:

As a result, South Korea would likely overtake the US as world semiconductor leader in a few years; China could attain leadership in the long term. As experience in communications network equipment and other tech sectors has shown, once the US loses its global leadership position, this dynamic effectively reverses the industry’s virtuous innovation cycle and throws US companies into a downward spiral of rapidly declining competitiveness and shrinking market share and margins. Lower R&D investment would inhibit the US semiconductor industry’s ability to deliver the breakthroughs that US technology and defense sectors rely on to maintain global leadership, and ultimately could force them to depend on foreign semiconductor suppliers.

In order to avoid these negative outcomes, policymakers must devise solutions that simultaneously address US national security concerns and preserve global market access for US semiconductor companies — a fundamental pillar of the proven innovation model that will allow the industry to continue to deliver technology breakthroughs that are crucial for US economic competitiveness and national security.

INTRODUCTION

US. leadership in semiconductor technology is essential for economic competitiveness and national U security—particularly as the world advances into the era of digital transformation and artificial

intelligence (AI). The leadership position of the US, which has long supplied 45% to 50% of worldwide semiconductor demand, is grounded in an innovation-intensive model that relies on access to global markets. This access provides the large customer base needed to achieve scale to fund the high levels of investment in R&D that allow US companies to maintain their technological edge over global competitors, and it enables the highly specialized supply chains required for the industry’s complex manufacturing processes. China accounts for a very large portion of the global semiconductor market, generating approximately 23% of demand in 2018.

The US-China frictions have generated significant headwinds for US semiconductor companies. Since the start of the “trade war” the median year-on-year revenue growth of the top 25 US semiconductor companies has plummeted from 10% in the four quarters immediately prior to the implementation of the first rounds of tariffs in July 2018, to approximately 1% in late 2018. And in each of the three quarters after the US restricted sales of certain technology products to Huawei in May 2019, the top US semiconductor companies have reported a median revenue decline of between 4% and 9%. Many of these companies have cited the trade conflict with China as a significant factor in their performance. Although the “phase one” trade agreement signed by the US and China in January 2020 contains provisions on key issues for the technology industry, such as China’s protection of intellectual property and its technology transfer practices, it does not address other issues such as the direct state support that China gives to its domestic semiconductor industry. In addition, restrictions on exports of US-based technology products to certain Chinese entities associated with US national security concerns still remain in place.

In this report, we evaluate how the ongoing US-China frictions may affect the US semiconductor industry under two scenarios. The first scenario assumes that current restrictions will remain in place, perpetuating the status quo. The second scenario considers a further escalation that results in a complete halt in bilateral technology trade, effectively decoupling the US and Chinese technology industries.

To quantify the potential risk to the US semiconductor industry, we have developed an analytical market model that provides a detailed view of semiconductor demand and supply structure by region, end application market, and product line. This model, which is based on public data, allows us to identify the portion of demand that comes from Chinese customers for each of the 32 product lines considered in our global semiconductor market

taxonomy. It also estimates how much of that demand is currently covered by US suppliers and how much goes to other suppliers that could take share from US companies that face restrictions in China.

We found that continued restrictions on exports to China could have profound negative repercussions for the US semiconductor industry. Our analysis shows that the US’s long-standing global leadership position in semiconductors is ultimately at stake.

While this report does not offer policy recommendations, our findings support the need for a more constructive, targeted and multilateral approach to the current frictions in technology trade between the US and China. A solution that addresses national security concerns and simultaneously preserves the fundamentals of the semiconductor industry’s innovation-led model is necessary if US semiconductor companies are to continue delivering technology breakthroughs that benefit enterprises and consumers in the US and around the world.

THE STRATEGIC IMPORTANCE OF

THE SEMICONDUCTOR INDUSTRY FOR THE US

Astrong, financially healthy semiconductor industry is strategically important to the US. Semiconductors A enable technology breakthroughs that drive economic growth and are critical for national security.

Enabling Technology Breakthroughs. The semiconductor industry has been at the heart of successive revolutionary advances in information and communication technology (ICT) over the past three decades. ICT breakthroughs, in turn, have become a driving force behind economic growth, enabling the US to significantly outperform other high-income countries both in productivity growth and in real GDP growth since 1988. The benefits of these technological advances made possible by US semiconductor technology have reached the rest of the world as well. For example, mobile communications has become the fastest globally adopted technology in history, and its global economic impact is estimated to exceed $1 trillion.

Over three decades, the number of transistors per wafer has increased by a factor of almost 1 million, yielding a 450,000-fold gain in processing power and a cost reduction of 20% to 30% per year. The blazing speed of this technological improvement has permitted the transition from mainframes in the 1980s to smartphones in the 2010s. Today, more than 5 billion consumers worldwide own a smartphone that has more computing power than the mainframe computer NASA used to send Apollo 11 to the moon. As a result, the intensity of semiconductor utilization (industry revenues as a percentage of worldwide nominal GDP) has surged by a factor of 2.8 since 1987. Global semiconductor demand has been growing at an annual average rate of 8.6%, reaching $475 billion in 2018.

We are now in the early stages of another massive technology-driven change in the global economy: the era of digital transformation and AI. Revolutionary applications such as augmented/virtual-reality experiences, self-driving vehicles, the Internet of Things (IoT), and Industry 4.0 systems, along with smart cities, are on their way to becoming commercial realities. Enabling each of these new applications are advances in semiconductor technology, including the following:

In addition, the semiconductor industry is now testing the first quantum computing prototypes, which can operate at speeds 100 million times faster than current computers. Quantum computing could revolutionize areas that require massive computing intensity, such as AI and cybersecurity.

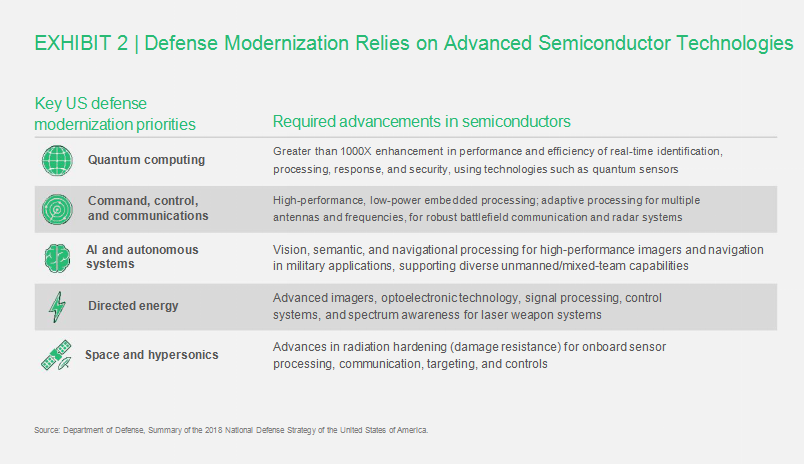

Safeguarding National Security. The semiconductor industry emerged in the 1950s from its origins in the US defense industry. Although the US Department of Defense (DoD) today accounts for approximately 1% of the industry’s revenue, electronics components are ubiquitous in defense and weapons systems, and therefore remain critical to US military capabilities. The defense modernization priorities laid out in the 2018 US National Defense Strategy include microelectronics, 5G, and quantum science as strategic areas requiring US investment. Other priority areas—such as cybersecurity, AI, autonomous systems, and advanced imaging equipment—rely heavily on advanced semiconductor capabilities, as well. (See Exhibit 2.) “Superiority in these technologies … is the key to deterring or winning future conflicts,” wrote Mike Griffin, the US Undersecretary of Defense for Research and Engineering, in a recent article in Defense News.

As digitally connected electronic systems become increasingly crucial for managing advanced weapons systems and critical infrastructure and information, the availability of trusted semiconductor suppliers that can deliver economically viable, reliable, and secured components will become even more important for national security. To this end, the Defense Advanced Research Projects Agency (DARPA), the R&D arm of the DoD, is spearheading a multiyear Electronics Resurgence Initiative. The program focuses on semiconductor design and fundamental technology development for military use through public-private partnerships with US companies. In parallel, the DoD is championing programs such as the Trusted and Assured Microelectronics initiative, which has the second-largest budget among 90 DoD R&D programs for 2020, to secure the manufacturing layer of the value chain used for domestic supply.

The Virtuous Circle Enabling US Semiconductor Leadership

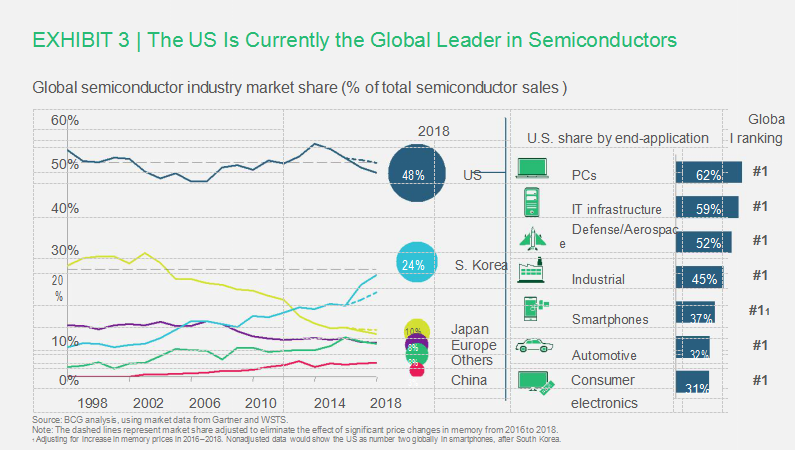

US semiconductor companies—including both integrated device manufacturers (IDMs), which design and manufacture their products in their own facilities, and fabless design companies, which rely on independent foundries to fabricate their chips—supplied approximately 48% of the global market for semiconductors in 2018, according to Gartner data. In fact, the US leads in 23 of the 32 semiconductor product categories in our industry taxonomy, and across all end-application markets, from PCs and IT infrastructure to consumer electronics. (See Exhibit 3.)

US semiconductor companies translate this market success into strong financial performance. They have delivered an average annual shareholder return over the past five years of nearly 14%, more than 4 percentage points higher than the S&P 500 market index, and they have reached a combined market capitalization of approximately $1 trillion as of November 2019. This sustained financial strength is critical to enable the industry to continue investing heavily in R&D into the future.

Indeed, the US semiconductor industry owes its global leadership to technological excellence and product innovations that resulted from massive R&D investments. Semiconductors are highly complex products produced from highly advanced manufacturing processes. Improvements often require breakthroughs in hard science that take many years to achieve. The US semiconductor industry has invested $312 billion in R&D over the past ten years, and $39 billion in 2018 alone—almost double the rest of the world’s combined level of investment in semiconductor R&D. For its part, the US government invests significantly in foundational research, which helps bridge the chasm between academic breakthroughs and new commercial products. However, government investment has been flat or declining in the US for many years in comparison with that of other countries. (See “Winning the Future: A Blueprint for Sustained U.S. Leadership in Semiconductor Technology”, Semiconductor Industry Association, April 2019.)

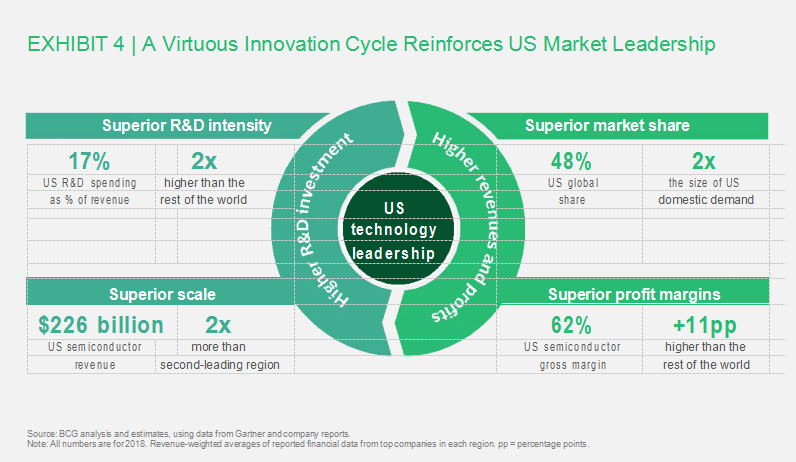

Technology leadership has enabled US companies to establish a virtuous circle of innovation. From the massive R&D effort comes superior technology and products, which in turn lead to higher market share and, typically, higher profit margins, thus refueling the virtuous circle. (See Exhibit 4.)

Two factors lie at the heart of this virtuous circle: R&D intensity and scale. Historically, US semiconductor companies have consistently invested about 17% to 20% of their revenues in R&D, significantly above the 7% to 14% invested by semiconductor companies in other regions. In fact, the level of R&D intensity for US semiconductor companies in 2018 was the second highest among all sectors of the US economy, behind only the pharmaceuticals/biotechnology sector.

Scale is the second pillar of the virtuous circle of innovation. With global product revenues of approximately $226 billion in 2018, the US semiconductor industry is much bigger than its counterparts in other competitor regions. It is twice as big as South Korea’s semiconductor industry, five times as big as Japan’s, six times as big as Europe’s, and 15 times as big as China’s.

Open access to international markets is a critical requirement for scale, as the US domestic market accounts for less than 25% of global semiconductor demand.1 Approximately 80% of US industry revenues come from sales to export markets, including China, which accounts for approximately 23% of global demand. According to data from the US International Trade Commission, semiconductors were the fourth-largest US export product by value in 2018, after aircraft, refined oil, and crude oil.

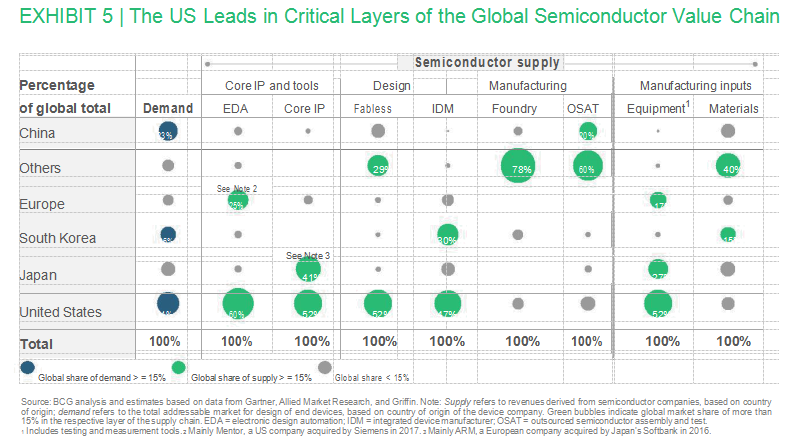

Global access also allows the US semiconductor industry to tap into highly specialized resources to manufacture increasingly complex products. For example, it takes about 1,500 steps using high-precision equipment in a $15 billion wafer fab to manufacture a leading-edge 7-nanometer chip. Although US companies can rely extensively on the domestic US semiconductor ecosystem for the design and equipment layers of the value chain, they also depend on foreign partners for various electronic materials; for the equipment used in certain processes; and for fabricating, assembling, and testing chips. No single company or country has the technical capability to control the entire supply chain. (See Exhibit 5.)

1.According to market data from Gartner. Demand is measured in design terms, not purchase or ship-to terms, to account for the fact that the customer—the original equipment manufacturer (OEM) that designs the end device and selects the semiconductor suppliers—may differ from the company that actually develops or assembles the device.

Intensifying Foreign Competition

Despite holding a clear leadership position globally, the US semiconductor industry faces considerable competition. Rapid product cycles in end markets such as smartphones, PCs, and consumer electronics—which account for more than half of total semiconductor demand—mean that US semiconductor companies must compete aggressively every year to win supply contracts for each new generation of devices.

In 18 of the 32 semiconductor product lines in our global industry taxonomy, representing 61% of total global demand, at least one non-US company has a global market share of 10% or more, giving it the potential to become a viable alternative to US suppliers. And US companies are vulnerable even in product areas—such as central processing units (CPUs), graphics processing units (GPUs), and field-programmable gate arrays (FPGAs)—where they currently hold an aggregate market share of more than 90%. That is because large global customers are increasingly designing their own custom chips for their data centers. They optimize these chips, known as application-specific integrated circuits (ASICs), for use in their own large base of hardware devices built for specific use cases involving massive data processing, such as AI, computer vision, and cryptocurrency mining. (See “When Silicon Meets Data”, BCG article, December 19, 2018.)

In particular, US semiconductor companies are seeing growing competition from South Korea and China, whose market share has increased by 12 and 3 percentage points, respectively, since 2009. At the same time, US firms are also encountering increased competition in the US home market, where leading European and Japanese semiconductor companies are stepping up investments to expand their portfolios and presence, often through major acquisitions.

South Korea

Part of South Korea’s share gain reflects surging demand for memory products, a category in which two of its companies are global leaders. Samsung’s strong push across a broad range of additional semiconductor products, such as display drivers, image sensors, and integrated mobile processors—both as an internal supplier to the company’s expanding hardware portfolio in consumer electronics and networking equipment and as a merchant supplier to other device manufacturers—has also contributed to South Korea’s gain. In March 2019 President Moon Jae-in instructed the government to take steps to boost the country’s competitiveness in the global semiconductor industry beyond the memory market.

China

China, meanwhile, has made steady progress in semiconductor design since the early 2000s, when it had virtually no presence. Developing a national semiconductor industry and easing dependence on foreign suppliers have been Chinese government policy priorities for decades. According to China Semiconductor Industry Association (CSIA) data, the total reported revenues of semiconductor companies operating in China have grown at over 20% annually during the past five years. Excluding the activity of foreign semiconductor companies in China, Chinese companies in 2018 achieved just a 3-4% overall share in both global semiconductor sales and semiconductor manufacturing.2 Progress has been most remarkable in fabless design, where China has seen an explosion of activity in recent years. CSIA reports that the country currently has more than 1,600 local firms with a combined 13% share of the global market, up from 5% in 2010.

On the demand side, although industry reports and media often employ a variety of higher numbers to refer to the size of the Chinese market, we believe that the value of semiconductor components incorporated into devices produced by Chinese original equipment manufacturers (OEMs) offers the best measure of the portion of global semiconductor demand truly driven by China. By this metric, China currently represents 23% of global semiconductor demand. This means that domestic semiconductor companies account for only 14% of the total needs of Chinese end-device manufacturers. (See Exhibit 6.)

2.Semiconductor sales include global revenues for both IDM and fabless design companies. Manufacturing revenues includes foundry and outsourced semiconductor assembly and test (OSAT) revenues, as well as revenues from IDM companies adjusted to Cost of Sales to reflect the value of production without the sales margin.

The government’s Made in China 2025 plan sets an ambitious target of semiconductor self-sufficiency. The goal is to have domestic suppliers meet 70% of the nation’s semiconductor needs by 2025. To support the effort, the country is using various policy levers, including state-backed investment funds that provide capital for homegrown semiconductor development and manufacturing. To date, the central and regional governments have committed around $120 billion to the plan. China is also actively pursuing overseas talent and merger-and-acquisition opportunities.

Although China is still far from achieving its goal of self-sufficiency, it seems to be making significant progress in several key areas of semiconductor design:

In light of these developments, analysts expect China to meet 25% to 40% of its domestic demand with locally designed semiconductors by 2025—more than double its current level but still below its own 70% ambition.

WHY US-CHINA FRICTIONS THREATEN US LEADERSHIP IN SEMICONDUCTORS

rade and geopolitical frictions between the US and China pose a new set of serious challenges for the US T semiconductor industry. Thus far, China has largely excluded semiconductors from the tariff increases it has imposed on US products in retaliation for higher US tariffs since early 2018 on a range of Chinese imports.3 Meanwhile, semiconductors are at the center of other contested issues, such as restrictions on access to US technology that the US government has imposed on Huawei and other Chinese entities that it regards as acting contrary to US national security or foreign policy interests.

The “phase one” agreement that the US and China signed in January 2020 contains provisions in several areas that are relevant to the semiconductor industry, such as protection of intellectual property and technology transfer requirements. However, it does not address other complex issues, such as state support for domestic semiconductor companies. And restrictions on certain Chinese entities’ access to US technology associated with US national security concerns remain in place.

Continuation of the bilateral conflict could jeopardize US semiconductor companies’ ability to conduct business in China on an equal footing with their competitors, both Chinese and from other regions. That could pose a direct risk to the estimated $49 billion of revenue (22% of its total revenue) that the US semiconductor industry derived from Chinese device manufacturers. The magnitude of the revenue at risk threatens the scale that the US industry needs to sustain its virtuous circle of innovation and global leadership.

In view of the current level of uncertainty, we have evaluated two potential scenarios:

Scenario 1: Perpetuation of the Status Quo. Under this scenario, China will impose no further tariffs on US semiconductors, but broad US restrictions on access to US-developed technology by Huawei and several other Chinese companies included in the Commerce Department’s Entity List will remain in place for the foreseeable

3.China has imposed tariffs on HS8541 (discrete semiconductors), affecting around 5% of Chinese semiconductor imports from the US. US tariffs affect all semiconductor imports from China, but the volume of such imports is quite small.

future4. Chinese companies not on the Entity List will be allowed to source semiconductors from US suppliers, except in the case of specific components that are already subject to export controls due to their military applications.

Scenario 2: Escalation Toward Decoupling the US and Chinese Technology Industries. In this scenario, US semiconductor companies will effectively be banned from selling to all Chinese customers—not just those on the current Entity List. The ban will encompass all semiconductor components sold to Chinese device manufacturers or to non-Chinese manufacturers that assemble their products in China. The ban will also apply to other technologies and products used in the semiconductor value chain—such as design tools and manufacturing equipment—for which US companies are global leaders.

The Impact of Scenario 1: Perpetuation of the Status Quo

We anticipate four key direct implications of a perpetuation of the status quo:

4.For the purpose of modeling the potential impact of this scenario, we have assumed that all sales of US semiconductor companies to Chinese companies on the Entity List will stop, irrespective of where products are actually developed or manufactured.

The first two effects described above will have minimal impact on the US semiconductor industry. Relocation of parts of tech supply chains to other countries to bypass US restrictions on imports from China would not trigger changes in semiconductor suppliers. With regard to changes in consumer and enterprise purchase decisions, although our market model predicts significant shifts in the individual market shares of leading brands in smartphones, PCs, and servers in specific regions, the net aggregated effect across all categories would be a small gain for Chinese device makers, as they would offset their share losses in overseas markets with gains in the domestic Chinese market. This would increase the size of semiconductor demand from Chinese device makers by just about 1% at the expense of other regions, which would ultimately translate into a modest revenue drop for US semiconductor companies.

The ast two effects listed above, on the other hand, entail a move away from US components by Chinese customers, which would have a significant negative impact on US semiconductor companies. First, all US semiconductors purchased by Huawei and other Chinese companies currently on the Entity List would have to be shifted to non-US suppliers. We estimate that US semiconductors for which no immediate alternative suppliers exist account for only around 10-15% of the total semiconductor demand of companies on the Entity List, meaning that those companies would be able to quickly find substitutes for almost all components. For example, for its Mate 30 flagship smartphone, released in September 2019, Huawei replaced components from US companies representing approximately 15% of the device’s semiconductor content with alternatives developed in-house or sourced from suppliers in other regions.

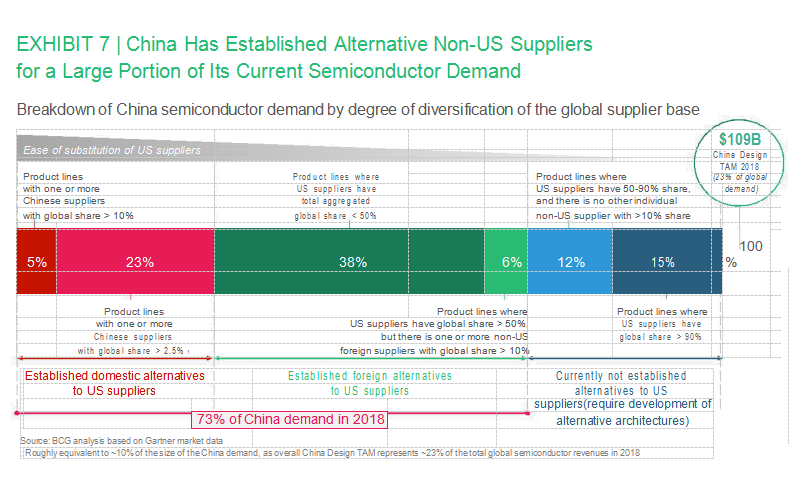

For Chinese companies that are not on the Entity List, the intensity of the effort to replace US suppliers could vary, depending on the perceived risk of further US restrictions and the availability of viable alternative suppliers for specific components. We expect that total or partial substitution of US suppliers will occur only if Chinese companies see a clear, low-risk opportunity to diversify their supplier base. We estimate that Chinese customers currently have established alternative non-US suppliers—either domestic or from other regions—for approximately 73% of their semiconductor demand in 2018. (See Exhibit 7.)

Specifically, our model includes the following assumptions:

Even under these moderate assumptions, our component-by-component analysis indicates that US companies may lose more than 50% of their current business in China as a result of the combined effect of the export restrictions to companies on the current Entity List and proactive supplier diversification by Chinese customers. Overall, we estimate that continuation of the current status quo would result in an 8-percentage-point reduction in the US semiconductor industry’s global market share. This would amount to a 16% drop in global revenues, equivalent to $36 billion in 2018. (See Exhibit 8.) Since most of the substitution would occur in devices with short product cycles, such as smartphones, PCs, and consumer electronics, most of the impact would probably be felt within two to three years.

US losses will be gains for both Chinese and global competitors. We expect that Chinese suppliers would capture approximately half of the revenue forgone by the US industry, enabling China to increase its global market share to around 7% and raise its semiconductor design self-sufficiency from 14% to 25%. That percentage would still be well short of the 70% target set by the Made in China 2025 plan, but it would be in line with the lower end of the range that analysts forecast on the basis of recent developments in the China semiconductor industry. The other half of the revenue lost by US semiconductor companies would flow to alternative suppliers from Europe or Asia. It is important to note that this shift of revenue from US to non-US suppliers would not make China more self-sufficient. This portion of the negative impact on US companies, therefore, would be entirely separate from and additional to the expected effect of the Made in China 2025 plan.

Aside from the impact of Scenario 1 on revenues, we estimate that semiconductor R&D expenditure would decrease by $5 billion to $10 billion annually and capital expenditure by $8 billion annually. This would result in the loss of more than 40,000 US jobs, 15,000 of which would be in the semiconductor industry. The loss in revenue would force US companies to reduce their annual investment in R&D by $5 billion, or 13%, if they were to maintain the same ratio of R&D to revenue that is now in place, in order to keep their operating margin constant. But given that total US industry revenue would likely stall or decline as a result of the estimated negative impact on their China business, US semiconductor companies might have to cut their R&D spending by as much as $10 billion, or 25%, in order to deliver a total shareholder return equal to the estimated cost of capital for the industry. This would effectively reverse the direction of the US semiconductor industry’s virtuous circle of innovation: lower R&D investments would reduce the ability of US companies to preserve their current

lead in technology and products over global competitors, causing further erosion of US share in markets other than China.

The Impact of Scenario 2: Technology Decoupling

An escalation of US-China trade tensions leading to a complete US technology export ban would effectively result in the decoupling of the two nations’ technology industries. It would shut US semiconductor companies out of the large China market and would force Chinese device makers to find alternative sources of supply. In response to US restrictions, we assume that China would also ban US software and devices such as smartphones, PCs, and data-center equipment from its domestic market. That would accelerate the nation’s foreign technology replacement plans, which are already scheduled to start in 2020 across state agencies and public institutions.

The degree of disruption for Chinese device manufacturers would vary by semiconductor component, with three different responses depending on the supply situation, as shown in the Exhibit 7:

5.device makers will shift their purchases to those established domestic suppliers5. This assumes that the alternative suppliers can remain competitive even without industry-leading design tools that currently

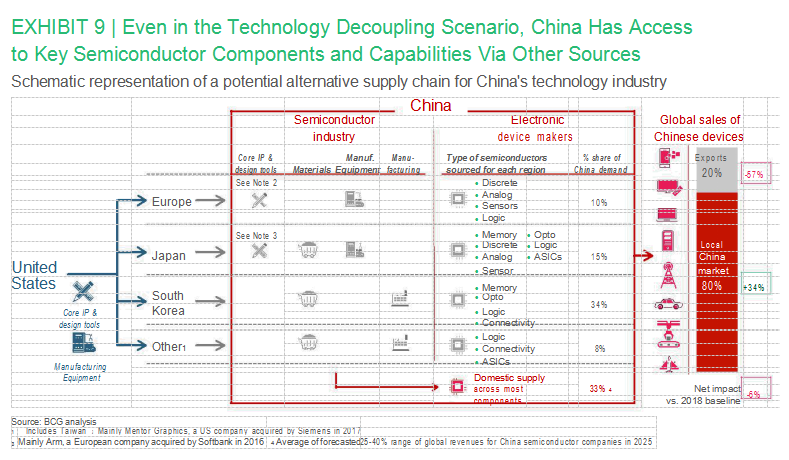

Under the technology decoupling scenario, China’s semiconductor supply chain would look dramatically different. (See Exhibit 9.) To the degree that China could maintain access to Asian and European semiconductor suppliers and foundries that would continue to use design tools and manufacturing equipment from US vendors, the anticipated disruption for Chinese device manufacturers would be somewhat limited in the medium to long term. Beyond the near-term turbulence involved in switching to new suppliers that would need to ramp up capacity quickly in order to cope with the surge in demand, the main challenge for China would be to develop viable alternative high-performance processors for computing-intensive applications, working closely with new suppliers elsewhere in Asia or Europe that could use advanced design tools from US vendors. China has already made progress here, having used non-US architecture to build ShenWei supercomputer processors. Europe’s European Processor Initiative and Fujitsu’s K and Post-K supercomputer initiatives suggest that European and Asian countries are themselves actively working to move away from US CPU suppliers and architecture.

Following this shift to newer and, at least in the near term, less advanced alternative components, Chinese PCs, servers, and other ICT infrastructure devices might no longer be as competitive in international markets. Chinese smartphones and other consumer electronics products might also lose market share as a result of not having access to US software, content, and applications, particularly in high-income economies. This could lead, in turn, to reduced overseas revenue for Chinese device makers. On the other hand, even with products that lack the most advanced technology, Chinese vendors would likely be able to expand their share of China’s domestic market, since competing US products would be banned. In fact, we estimate that Chinese device manufacturers would be able to recover as much as 75% of their overseas revenue loss by expanding their share of the domestic market.

The main impact that technology decoupling would have on China, however, might be on its economy’s overall productivity during the years-long transition period toward a domestic IT ecosystem based on alternative processor architectures. Even if such alternative processors could match the performance of well-established US designs, China would need to create and scale up completely new hardware and software stacks, for both consumer and enterprise applications. It would take investment and time for Chinese companies to migrate all systems and business processes to the new IT infrastructure and to catch up in user functionality and cost with US-technology-based products that most enterprises and consumers around the world currently use.

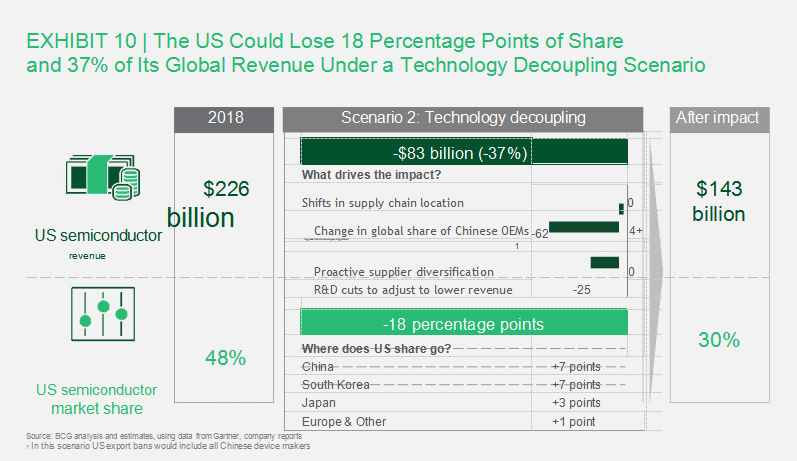

The direct impact of decoupling on US semiconductor companies would be the loss of all revenues from Chinese technology customers, as well as from customers based in other countries that would also end up decoupled from the US. Overall, once direct and indirect impacts are taken into account, US semiconductor revenue would decline by 37%, equivalent to $83 billion in 2018. (See Exhibit 10.) Around three-quarters of this impact would be the direct consequence of the forced replacement of US semiconductors by Chinese customers in response to the US technology export ban. Therefore, it would hit almost immediately after the US restrictions went into effect.

Such a dramatic revenue loss would trigger deep cuts in R&D investment by US companies—on the order of at least $12 billion, or 30%, if they maintained their current R&D intensity rate. The reduction in R&D spending might have to reach 60% if, despite significant revenue contraction, US semiconductor companies aimed for a total shareholder return equal to the estimated cost of capital for the industry. In addition to R&D cuts, capital expenditure would decrease by $13 billion, resulting in the loss of 124,000 US jobs, 37,000 of them in the semiconductor industry.

In time, US semiconductor companies would likely lose their technology and product advantages over global competitors, leading inevitably to further market share erosion. We estimate that, in the medium to long term, the global share of US semiconductor companies would drop from 48% to approximately 30%. The US would also lose its long-standing global leadership position in the industry.

Which rivals pick up the revenue from Chinese customers forgone by US semiconductor companies would depend on China’s ability to develop alternative domestic suppliers. That ability would vary by product and time horizon.

Given the current state of development of China’s semiconductor industry, most of the revenue in the near term would flow to third countries. Chinese semiconductor companies would grow aggressively to serve approximately 40% of the domestic demand—almost 3 times the current level of self-sufficiency, and at the upper range of analysts’ forecasts for 2025. In addition, our model shows that South Korea, thanks to its strong capabilities in key products such as memory, displays, and imaging and mobile processors—along with its ability to scale up manufacturing capacity—would likely replace the US as the global semiconductor leader.

Over the medium to long term under Scenario 2, China might succeed in developing a competitive domestic semiconductor design industry that could cover most of its domestic demand. That would take time, however, and would require sustained high levels of investment. Although China managed to catch up in just five to seven years in technology products such as solar panels, LCD displays, and smartphones, it did so with access to foreign technology and components. In the case of semiconductors, the technological barrier is much higher. As an illustration, it took South Korea and Taiwan approximately 15 to 20 years to become global leaders in memory and wafer fabrication, respectively.

Furthermore, as we noted earlier, the technological complexity of semiconductors is so high that no country has a fully indigenous production process in place and complete self-sufficiency across the entire value chain. China might still have to rely on foreign design companies for highly complex chips that require advanced design tools from US vendors, as well as on foundries elsewhere in Asia to manufacture some of its locally designed chips, particularly those requiring advanced manufacturing nodes.

Even if China had to import alternative high-performance processors to replace CPUs, GPUs, and FPGAs based on US technologies, over time Chinese semiconductor companies might eventually be able to meet the nation’s domestic needs for almost all other semiconductor products. Doing so would put China’s self-sufficiency at approximately 85%. In that case, the global share of the Chinese semiconductor industry would grow from 3% to more than 30%7, displacing the US as the global leader.

7.Including forecasted exports from Chinese semiconductor companies that would have become global contenders at this point given their scale.

Structural Implications for the Semiconductor Industry

Our analysis suggests that frictions between the US and China will have a profound negative effect on the US semiconductor industry. Our global market model indicates that the US will lose 8 to 18 percentage points of share, depending on the scenario. (See Exhibit 11.)

This impact is much more severe and will happen much faster than the anticipated effect of the Made in China 2025 plan alone. Analysts currently forecast that China semiconductor companies—including both IDMs and fabless design companies—may grow their revenues at a rate of 10% to 15% per year, raising their coverage of domestic demand from 14% in 2018 to between 25% and 40% by 2025. Such growth would translate into a gain of between 4 and 7 percentage points in global market share for the Chinese semiconductor industry, consistent with forecasts in our model for Scenarios 1 and 2. In the absence of restrictions on sourcing US technology, the replacement of foreign semiconductors under the Made in China 2025 plan would affect both US and non-US suppliers. Assuming that the degree of substitution is proportional to current market shares, our market model predicts that US semiconductor companies would stand to lose just 2 to 5 points of global share due to the Made in China 2025 effect alone. That market share loss is about four times lower than the market share loss in the two scenarios of US-China frictions that we have evaluated.

Two main reasons explain the much more negative impact associated with the US-China frictions. First, in the case of semiconductor components for which domestic suppliers are available, we expect that Chinese device makers will target replacement of US suppliers and choose to keep non-US suppliers as a second source where needed. In addition, facing US export restrictions (or even the perceived risk that the US might impose such restrictions on companies outside the Entity List in our Scenario 1), Chinese device makers would also attempt to replace US semiconductor suppliers with other Asian or European vendors—even if that substitution did not contribute to achieving the Made in China 2025 goals.

Beyond the financial impact, our analysis also reveals a risk that shutting US semiconductor companies out of China’s market could trigger dramatic structural change in the industry, with deep, irreversible implications for US economic competitiveness and national security. If the global share of US semiconductor companies slips to approximately 30%, the US will cede its long-standing global semiconductor leadership position to either South Korea or China. More fundamentally, the US could be at risk of having to depend to a significant degree on foreign suppliers to serve its own domestic demand for semiconductors. And with a projected 30% to 60% reduction in annual R&D investment, the US industry might no longer be able to deliver the technology advances necessary to meet the future needs of the US’s defense and national security systems.

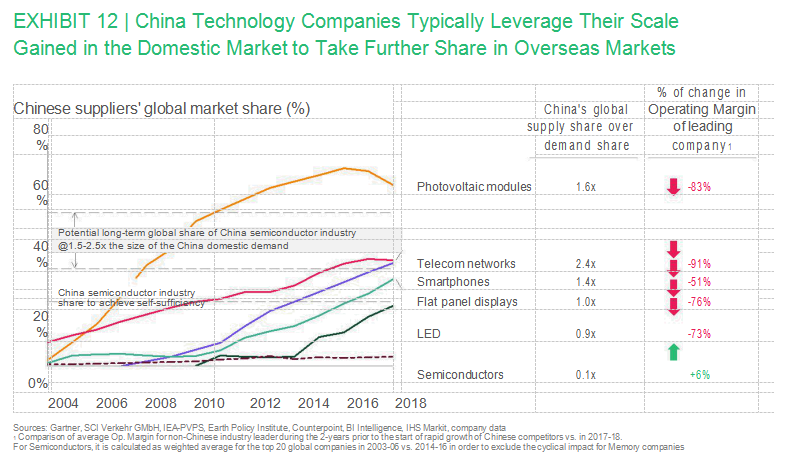

The downside risk for the US semiconductor industry may not stop there. Once the US industry loses its global leadership position, as it is very likely to happen in Scenario 2, it will be extremely unlikely to regain it. If our medium- to long-term Scenario 2 materializes and China emerges as the global leader, the US semiconductor industry will likely face additional share erosion beyond the 18 percentage points that we have forecasted. In the absence of trade barriers, Chinese competitors will not limit themselves to dominating their domestic market. In several other technology sectors, Chinese companies have leveraged the scale advantage that they built in their domestic market to seize market share with low prices in overseas markets, reducing industry profit margins by between 50% and 90%. (See Exhibit 12.)

If this pattern holds, Chinese semiconductor companies are likely to become aggressive contenders in international markets, too, capturing further global share. This, in fact, is precisely the ambition set by China’s State Council in 2014 that led to development of the Made in China 2025 plan: the ultimate goal is for China to become a global leader in all segments of the semiconductor industry by 2030. An extrapolation of the ratio between the global market share of Chinese companies and the weight of China’s domestic market observed in other technology sectors indicates a potential 35% to 55% global share for the Chinese semiconductor industry in the long term. As Chinese semiconductor players accelerate their overseas expansion, industry margins are likely to compress dramatically. As a result, US semiconductor companies will no longer be able to sustain today’s high R&D intensity. The current virtuous cycle of innovation could reverse, and instead become a vicious cycle in which US companies fall into a downward spiral of declining competitiveness and shrinking market share and profits.

The experience of the telecom network equipment sector, which today is at the center of ongoing US-China frictions due to significant national security concerns, illustrates these dynamics. In 2000, three North American companies—Lucent, Nortel, and Motorola—were global leaders, with approximately $100 billion in total combined revenues. After demand dried up during the tech downturn that followed the bursting of the dot-com bubble, networking equipment companies’ revenues plunged. By 2005 the combined revenues of the three companies had fallen by 45%. As a result, they were forced to restructure their businesses and slash costs, including R&D. Although they kept investing the same 12% of their revenues as in the pre-crisis years, their annual combined R&D spending dropped from $12 billion to $6.7 billion, a 45% reduction in just five years.

This impaired their ability to maintain their technological lead over their European competitors and to support new product development in the evolving wireless equipment market, just as carriers across the world were rolling out wireless networks based on new technology standards. At around the same time, Chinese manufacturers that had entered the market in the mid-1990s began to introduce “good enough” networking equipment at much lower prices. The Chinese contenders rapidly expanded at home and in emerging markets, and by 2008 had captured around 20% of the global market. Over the ensuing decade, the share of Chinese telecom network equipment companies has nearly doubled, to 38%. Meanwhile, the three former North American giants ended up being acquired by their European competitors for a fraction of their former valuation. Today, there are no US-based suppliers of radio-access network infrastructure, which is critical for the rollout and management of the 5G networks underlying the next wave of applications that will transform the global economy as they usher in everything from massive IoT applications to autonomous vehicles.

PRESERVING “WIN-WIN” GLOBAL ACCESS FOR THE SEMICONDUCTOR INDUSTRY

Over the past 30 years, the semiconductor industry has been at the heart of technological advances that have generated enormous benefits for the US economy, US defense capabilities, and consumers and

enterprises around the world. It has also created benefits for China, whose technology industry has been able to use foreign semiconductor components to develop increasingly competitive electronic devices that are gaining share in global markets.

These advances in semiconductors were the fruit of a virtuous cycle of innovation that relied on adequate protection of intellectual property and free and fair access to global markets—both for core technology and for tools—as well as on highly specialized supply chains that brought these innovations to end customers.

ecent frictions between the US and China, fueled by reciprocal national security concerns, have led to policies that seek to impose broad barriers to access to markets, technologies, and resources. Safeguarding national interests is critical, of course. But policy mechanisms require careful consideration if they are to avoid permanently harming the innovation model that has enabled the semiconductor industry’s success.

From a US perspective, our analysis shows that imposing broad unilateral restrictions on US semiconductor companies that prevent them from serving Chinese customers may backfire and risk endangering the US’s long-standing global leadership in semiconductors. Ultimately, this could result in significant US dependence on foreign semiconductor suppliers to serve the needs of the US technology industry, which has been the core engine of productivity gains and economic growth for the past three decades. Similarly, a dramatically scaled-down US semiconductor industry that no longer functioned as a global leader would not be able to fund the level of R&D investment required to fulfill needs for advanced semiconductors for critical defense and national security capabilities.

Preserving access to cutting-edge technology also serves China’s interests, particularly as it seeks to accelerate its economy’s transition toward a new growth model that relies more on higher-value-added products and technology-enabled productivity improvements. Finding constructive ways to address some of the concerns expressed by the US, such as strengthening the protection of intellectual property and ensuring a level playing field for foreign semiconductor companies, may also benefit China’s own technology development aspirations. Such measures could further encourage foreign investment in R&D activity in China, favor inflows of know-how and talent that China needs in order to upgrade its own domestic industry’s capabilities, and ultimately stimulate healthy competition in innovation and quality.

A strong US semiconductor industry, well integrated into the global technology supply chain, is vital to continued delivery of advances that will make the new era of digital transformation and AI possible. As with the mobile revolution, the massive benefits of such breakthroughs will reach consumers and enterprises in all countries, not just in the US. It is therefore urgent that the US and China find a new balance that, while safeguarding their respective national security interests, allows US semiconductor companies to continue investing heavily in R&D and making their cutting-edge products widely available to innovative device makers around the world, wherever they are.

APPENDIX: METHODOLOGY

To evaluate the potential impact of the US-China frictions on the semiconductor industry, we have

T developed a market model that provides a detailed view of semiconductor demand and supply structure by region, end application market, and product line. The model is based on market data from Gartner, cross-checked with semiconductor sales data from WSTS. We have supplemented with other sources such as IDC for specific end devices such as smartphones, PCs, servers and storage systems. We have also leveraged multiple analyst reports for forecasts of the development of China’s semiconductor industry over the medium term and the potential impact of the Made in China 2025 policy.

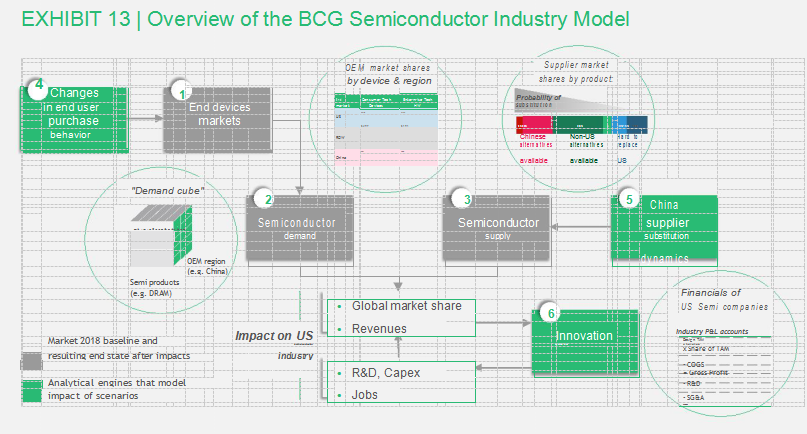

The model consists of six interconnected modules (see Exhibit 13):

Modules 1, 2 and 3 establish the baseline of the semiconductor market both globally and in China for 2018:

The end devices module models the demand and supply for electronic devices that utilize

1| semiconductors. We have considered seven different types of end devices: smartphones, PCs, consumer electronics, data centers, network equipment, automotive, and industrial and commercial equipment. For each of these seven end application markets, we have developed a matrix that breaks down both supply and demand by region. This allows us to quantify the global share of Chinese device makers in each application market, and how much of that share comes from the Chinese domestic market vs. export markets. For example, this module shows that Chinese companies have a 36% share of the global smartphone market measured in value. China’s domestic market accounts for 54% of their revenues; emerging markets such as Southeast Asia, Latin America, Eastern Europe, Middle East and Africa generate 33% of their revenues; and the remaining 13% of their revenues comes from high-income regions such as the US, Western Europe, Japan and South Korea.

2|The semiconductor demand module decomposes the $474 billion of global semiconductor revenues in 2018 across 32 product categories using market data from Gartner. (See Exhibit 14.) Semiconductor revenues by product category are then mapped to the 7 types of end devices and 7 demand regions covered in the 1| End devices module. We have built a “data cube” showing what portion of the total global revenues for each of the 32 individual semiconductor product categories comes from which type of end device, and from which region. This allows us to calculate the demand for each semiconductor product that comes from Chinese device makers. In our view, this is the most appropriate measure of the size of the Chinese semiconductor market, as it does not include the semiconductors shipped to China for the manufacturing of foreign devices – such as Apple’s iPhones – in Chinese factories. Based on this methodology, we estimate that the total semiconductor demand from Chinese device makers amounted to $109 billion in 2018, representing 23% of global semiconductor revenues. This number is below the approximately $160 billion often seen in reports as the size of China’s semiconductor market based on underlying WSTS data – but this figure includes semiconductors purchased and shipped to China to manufacture devices of non-Chinese brands.

3| The semiconductor supply module maps the key semiconductor suppliers for each of the 32semiconductor product categories considered, and their respective global market shares. We have then estimated the share of China’s demand calculated in the 2| Semiconductor demand module commanded by semiconductor companies from China, US, Europe, Japan, South Korea and elsewhere in Asia. Since there is no complete set of public data about sales of individual semiconductor products to Chinese companies, we have applied some assumptions based on our industry knowledge. Essentially, we have assumed that all revenues of Chinese semiconductor companies come only from Chinese customers, and that Japanese and South Korean suppliers have also a higher share in their respective domestic markets than elsewhere. Aside from these adjustments, suppliers’ shares in each demand region are expected to be in line with their observed global shares. For example, this module estimates that in aggregate Chinese semiconductor companies supplied 14% of the demand from Chinese device makers in 2018, while US suppliers accounted for approximately 45% of China’s demand. For some products such as the integrated baseband/application processor used in smartphones, the share of Chinese suppliers was higher than the overall 14%. In others such as FPGAs, CPUs or GPUs there were no Chinese suppliers with a share of at least 10% of China’s demand.

The modules 4, 5 and 6 are the “analytical engines” that model the expected changes in the behavior of end users and device makers under the different scenarios considered:

4| The end user purchase behavior changes module evaluates the impact of changes in attitudes of end users, both consumers and businesses, on the market shares of device makers across regions. We have modeled two types of impact, which go in opposite directions and partially offset each other.

5|The supplier substitution module evaluates the changes in market shares of semiconductor companies resulting from the supplier substitution efforts of Chinese device makers. We have modeled three different supplier substitution dynamics that will occur in parallel over the next few years:

For modeling purposes we have assumed that established, competitive domestic suppliers are those who have at least a 2.5% global market share – which would be equivalent to approximately 10% share of the Chinese domestic market. If there is no single Chinese company that meets that threshold for a given semiconductor product category, we assume that foreign suppliers will maintain their current shares. Similarly, if there is only one established Chinese supplier available, we assume that Chinese companies will still source 30-50% of their total volume from foreign vendors in order to have a diversified supplier base.

Absent US export restrictions such as the ones we consider in our scenarios 1 and 2, it is important to note that the substitution triggered by the Made in China 2025 policy alone is assumed to impact both US and non-US semiconductor suppliers similarly, with no bias against US companies. So in this substitution dynamic the share gain of Chinese suppliers will come at the expense of both US and non-US companies more or less proportionally to their market shares in 2018.

For modeling purposes we have assumed that the US ban covers all semiconductors sold by companies headquartered in the US to Chinese device makers, irrespective of where those semiconductors are actually developed or manufactured. This does not perfectly match the literal form of the US ban on the ‘Entity List’ introduced in May 2019, which has been defined to include the semiconductors made in the US — by both US and non-US companies — and also those made outside the US — again by both US and non-US companies — where US-origin content exceeds the de minimis threshold for China, currently established at 25%. However, based on estimates for some individual products, we believe that our modeling rule – which in practice implies a zero de minimis threshold for semiconductors made abroad by US companies — provides a good approximation.

Chinese device makers in this situation will shift all of their purchases of US semiconductors to Chinese suppliers – for products where at least one established Chinese supplier is available – and/or foreign non-US suppliers. For products for which US companies currently hold 90% or more global market share, Chinese device makers will be forced to bring in alternative sources, even if their alternative products do not yet completely match the performance of the existing US options. An example of this approach is Huawei’s push into server processors based on Arm architecture as alternative to chips based on the US-developed x86 architecture, both to equip its own cloud data centers and also for commercial servers and storage systems that it sells to customers.

For modeling purposes we have assumed that established, competitive non-US suppliers are those who have at least a 10% global market share. If there is no single non-US company that meets this threshold for a given semiconductor product category, we assume that US suppliers will maintain their current shares. Similarly, if there is only one established non-US supplier available, we assume that Chinese companies will still want to keep their current US vendors with 30-50% of their total volume in order to have a diversified supplier base.

How each of these 3 types of substitution plays is different depending on the scenario. Exhibit 15 provides an overview of the dynamics that we have assumed in each of the scenarios considered:

6| The innovation cycle effect module translates the changes in global market shares and revenues into impact on R&D investment, capital expenditures and jobs. Given the industry’s virtuous innovation cycle described in the report (see Exhibit 4), we assume that significant reductions in R&D make it harder for US companies to sustain their technological edge over their global competitors, ultimately leading to loss of competitiveness and further revenue share erosion over time.

To estimate the impact on R&D and capital expenditures, we have compiled the financials of the top 20 US semiconductor companies, which together account for over 90% of the total US industry revenues. Data on the industry jobs, both direct and indirect, comes from the SIA annual reports. As they confront the significant direct impact in market share and revenues that our model predicts for scenarios 1 and 2, US companies will need to reduce spend to maintain their current profit margins. At a minimum, we would expect companies to cut R&D and capital expenditures in the same proportion to the revenue declines, maintaining the ratios of spend as a percentage of revenues constant.

In addition, we have also used BCG’s proprietary Total Shareholder Return (TSR) analytics to understand the contribution of revenue growth, profit margins and other factors to stock price appreciation. Not surprisingly, revenue growth is the biggest driver of shareholder value creation in semiconductors. Our model indicates that the US semiconductor industry will lose a significant portion of its global revenues under both scenario 1 (16% decrease in revenue vs. the 2018 baseline) and scenario 2 (37% decrease in revenue vs. the 2018 baseline). So the US industry is likely to transition from a period of 10% annual revenue growth in 2013-2018 to a period of revenue decline in the next 3 to 5 years. As a result, US semiconductor companies will have to overcompensate with profit margin improvements to maintain their shareholders’ rate of return on investment above the estimated cost of capital for the industry. This will require steeper cuts in R&D and capital expenditures, much deeper than the decrease in revenues.

In turn, these significant reductions in R&D investment by US companies will lead to further share erosion over time in markets outside China, as global competitors – who will likely be increasing their total R&D investment as they benefit from stronger revenue growth from the substitution of US suppliers in China – catch up with US innovations. We have estimated this additional second order impact for each of product line by making some specific modeling assumptions based on the R&D intensity of the product – measured as the percentage of R&D spend over revenues observed in the financials of the leading US companies in each specific product category – and the estimated R&D cuts triggered by the loss of revenue from Chinese customers coming from module 5 | Supplier substitution. Products with high R&D intensity and large expected share loss from China’s supplier substitution will experience higher additional market share erosion in other markets outside China due to the ‘innovation cycle’ effect. This impact will be quite significant: based on our model, we expect it to deepen the revenue loss coming from the Chinese market for US semiconductor companies by an incremental 30% to 40%, depending on the scenario (see figures for the “R&D cuts to adjust to lower revenue” line in the chart on the top half of exhibits 8 and 10.)

Comprehensive service

To provide customers with a full range of one-stop services

Efficient team

Professional personnel sincere cooperation to speed up the service

Integrity specification

The enterprise serves the old brand, the service is credible has the safeguard

High quality after-sale

Make regular telephone visits and provide follow-up services